We've been with our current technology platform for more than 30 years, and now it's time to upgrade to bring you better banking experiences.

We've been with our current technology platform for more than 30 years, and now it's time to upgrade to bring you better banking experiences.

You may notice changes in our systems, but you'll find the same services and trusted bankers in all of our 10 banking offices in Eastern Arkansas. We're still locally owned and operated and look forward to providing you with better service and technology, while maintaining the same strength and stability you've come to expect over the past 133 years.

Want some details? Expand any of the sections below to learn more about these exciting changes:

*For details on accessing your new online banking account for the first time, please refer to the customer guide you received in the mail, or call 870.238.8171.

{beginAccordion}

Important Dates

Your new debit card will arrive in the mail within the next few days.

Prior to this date, record the automated bill payments you have set up in online banking. We expect all or most of your online banking bill payments to automatically transfer to the new system, but please verify your transfers for accuracy on April 1.

Online and mobile banking will be unavailable during our systems transition weekend from Friday at 2:00 p.m. CST until Monday, April 1, at 8:00 a.m. CST at the latest. Any scheduled or recurring bill payments, transfers or direct deposits set for March 29-31 will be processed on April 1.

You will receive a checking account statement dated March 31. Moving forward, your monthly checking account statement dates should mirror the dates typically seen for your checking account.

You will receive a savings account statement dated March 31. Moving forward, you will receive a savings account statement every three months, and interest will be paid quarterly.

If you have elected to receive electronic statements, your statements will continue to be delivered electronically.

Your newly activated debit card will be available for use.

Download our NEW mobile banking app “Cross Bank” and delete the former app “Cross Bank 2GO.”

As always, keep your device updated with the most recent software for the best banking experience.

The first time you login to online banking or your mobile banking app, you will enter your existing username and a temporary password. Once you have successfully logged in for the first time, you will set your new password.

Temporary passwords – Personal

Your temporary password will be the first four letters of your last name (lower case) and last four digits of your Social Security number.

Banker = bank9912

Lee = lee6789

O’Brien = obri5471

Temporary passwords – Businesses

Your temporary password will be the first four letters of the business name (lower case), and the last four digits of your Tax ID number.

The Bank = theb1234

A1 Company = a1co8741

Setting your NEW password:

At first login, you will be required to change your password from the temporary password. Passwords require the following:

• Must be a minimum of 10 characters.

• Must have at least one lower case letter (a – z)

• Must have at least one upper case letter (A – Z)

• Must have at least one number (1 – 9)

• Must NOT include any of the following special characters: $ ( ) ! * ? # “ / : & ^ , % ~ = [ ] Í ‘ { } ` \ Ø or a blank space

Your online banking transaction history, scheduled transfers, and all or most of your established bill payments will transfer to the new system automatically. Please verify that your recurring bill payments have been entered, and re-enter any that did not automatically transfer. If you use account nicknames, please re-enter your nicknames. Please set up your preferred online and mobile banking alerts.

If you use the Personal Financial Manager tool in online banking, please re-establish your categories, budgets and goals. You will be prompted to view our tutorial to see the new features we’ve added.

The first time you access Telephone Banking, you will be prompted to identify yourself with your social security or tax ID number, and a temporary password, which is the last four digits of your social security number. Once you have successfully logged in, you will set your new password.

What's Staying the Same

Cross Bank’s ownership, Board of Directors, and Management

Your Cross Bank team, our board of directors and stockholders are all still here working hard for you. We’re excited to launch this upgraded platform to better serve you today, and for decades to come.

Employees

You’ll find the same local bankers you know and trust here to serve you. In fact, you may notice their smiles are a little bigger, as our new banking system is easier for our customers and our employees.

Your account numbers and Cross Bank’s routing number

There will be no changes to your account number or Cross Bank’s routing number.

Direct deposits to your accounts and auto drafts charged to your accounts

These will continue without interruption. However, automatic payments tied to your debit card will need to be updated with your new debit card information.

Your accounts and all features

Your checking, savings, CD and loan accounts will have all the same benefits and features.

Printed checks

Business as usual! There will be no changes to printed checks.

Locations, hours, phone numbers

We still have the same locations, hours and phone numbers. (See page 18 of this guide.)

Loan payments

No change to how you make your loan payments.

Our person-to-person payment service

iPay continues with no interruption, allowing you to make secure payments.

Your New Visa Debit Card - Important Dates & New Features

Your new debit card will arrive in the mail within the next few days. For security purposes, it will be in a plain envelope, so be on the lookout. Follow the instructions in the letter to activate your new card and establish your debit card PIN. Keep your new card in a safe place until April 1 when you can begin using it.

Your newly activated debit card will be available for use, and your former debit card will no longer be usable. If you have recurring payments tied to your card, (streaming services, mobile phone providers, insurance companies, gyms, etc.), contact each company to update your account with your new debit card information. You should also add this information to your device’s mobile wallet if you choose.

New Features:

Enhanced Security with Chip Technology

The embedded chip on your new Cross Bank Visa debit card provides enhanced security - each transaction generates a transaction-specific, one-time code, that’s nearly impossible to counterfeit.

Tap and Pay – Safe, Secure, Convenient

Tapping to pay with your Cross Bank Visa debit card is even easier than swiping or inserting your card. To make a payment, your contactless card must be placed within 2 inches of the Contactless Symbol located on the checkout terminal for the transaction to take place (so you can’t pay accidentally).

Control your new debit card from your mobile phone or desktop.

Look for the Cards section in the Cross Bank app or when you login online. There you can pause your card, manage card limits, set alerts and travel notifications; all designed to secure your card and spending, while giving you peace of mind.

Debit Card Savings

We’ve made saving easier every time you use y our Cross Bank debit card. Access the Round Up Savings feature in our mobile app and online banking to round up your debit card transactions to the nearest dollar, or by an additional $1, $2, $3 or $5, and have the difference deposited in the Cross Bank account of your choice. Think of this as your digital piggy bank, allowing you to save the change.

New Features & Technology

Uncomplicated & Modern Design

The design is intended to improve your digital experience, and it’s made easier with a tutorial at your first login!

Security enhancements

You’ll have the ability to add multifactor authentication to your online and mobile banking login to better secure your account. You can choose text message, email, or use an authenticator app on your mobile device to receive a verification code to complete the login process. And we’re adding mobile banking biometrics, including fingerprint identification and facial recognition; depending on your phone’s capabilities.

Mobile deposits made easy

Make deposits on your laptop and tablet by simply using the camera on your device. Mobile deposits have never been easier or more convenient!

Real-time banking transaction posting

This means your account is always up to date!

Language-selection

Online and mobile banking will default to English, with the option of Spanish.

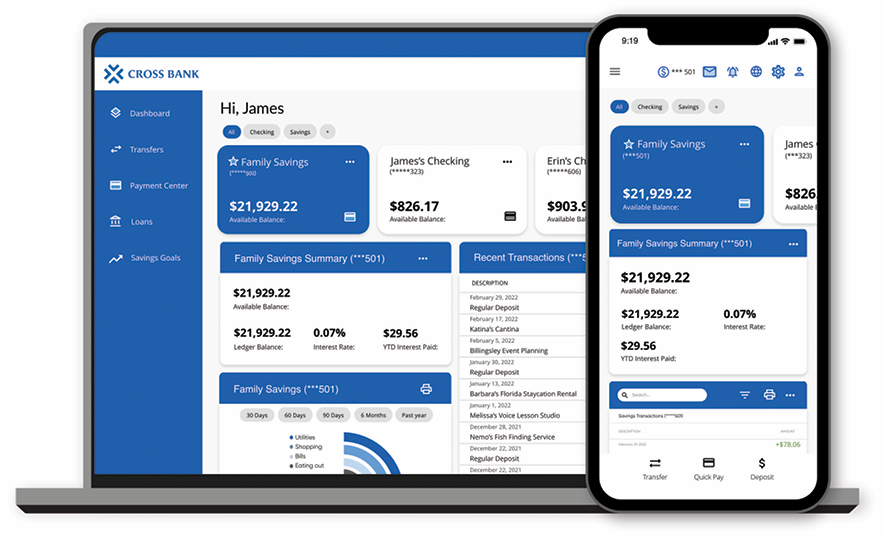

Online & Mobile Banking Have a New Look

NEW Mobile Banking App

Download our new app (Cross Bank) on April 1, and delete the former app (Cross Bank 2GO).

Online Banking: Manage your Money Anytime, Anywhere

Start by viewing the step-by-step demos for our most popular online and mobile banking features. You’ll automatically see the demo when you login for the first time.

New Dashboard:

It’s a snapshot of your finances in one place.

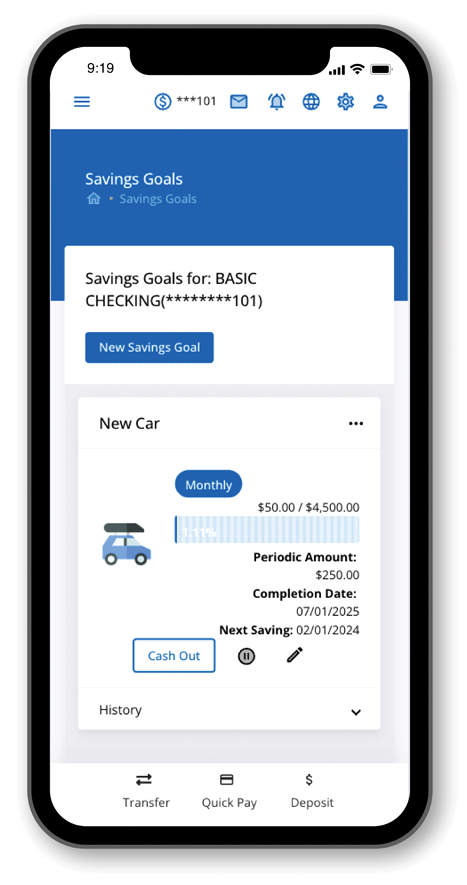

A New Look to Your Personal Finance Manager

We’ve made it easier to set savings goals and track your progress.

{endAccordion}